The 9-Minute Rule for Feie Calculator

Wiki Article

Getting The Feie Calculator To Work

Table of ContentsThe Main Principles Of Feie Calculator 5 Simple Techniques For Feie CalculatorThe 9-Minute Rule for Feie CalculatorFeie Calculator Fundamentals ExplainedFeie Calculator Fundamentals Explained

He offered his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his partner to help fulfill the Bona Fide Residency Examination. Neil points out that purchasing building abroad can be challenging without first experiencing the place."We'll definitely be beyond that. Even if we come back to the US for physician's appointments or business phone calls, I doubt we'll spend greater than thirty day in the US in any offered 12-month period." Neil emphasizes the value of rigorous monitoring of united state gos to (American Expats). "It's something that people need to be truly diligent about," he says, and recommends expats to be cautious of common blunders, such as overstaying in the U.S.

Excitement About Feie Calculator

tax obligation responsibilities. "The factor why U.S. tax on around the world earnings is such a large bargain is due to the fact that many individuals neglect they're still based on U.S. tax obligation also after transferring." The united state is among the couple of nations that taxes its residents no matter where they live, meaning that even if an expat has no revenue from united stateincome tax return. "The Foreign Tax Credit report allows people working in high-tax nations like the UK to counter their united state tax responsibility by the quantity they have actually currently paid in taxes abroad," states Lewis. This makes certain that expats are not exhausted twice on the very same income. Those in low- or no-tax countries, such as the UAE or Singapore, face additional obstacles.

Our Feie Calculator Statements

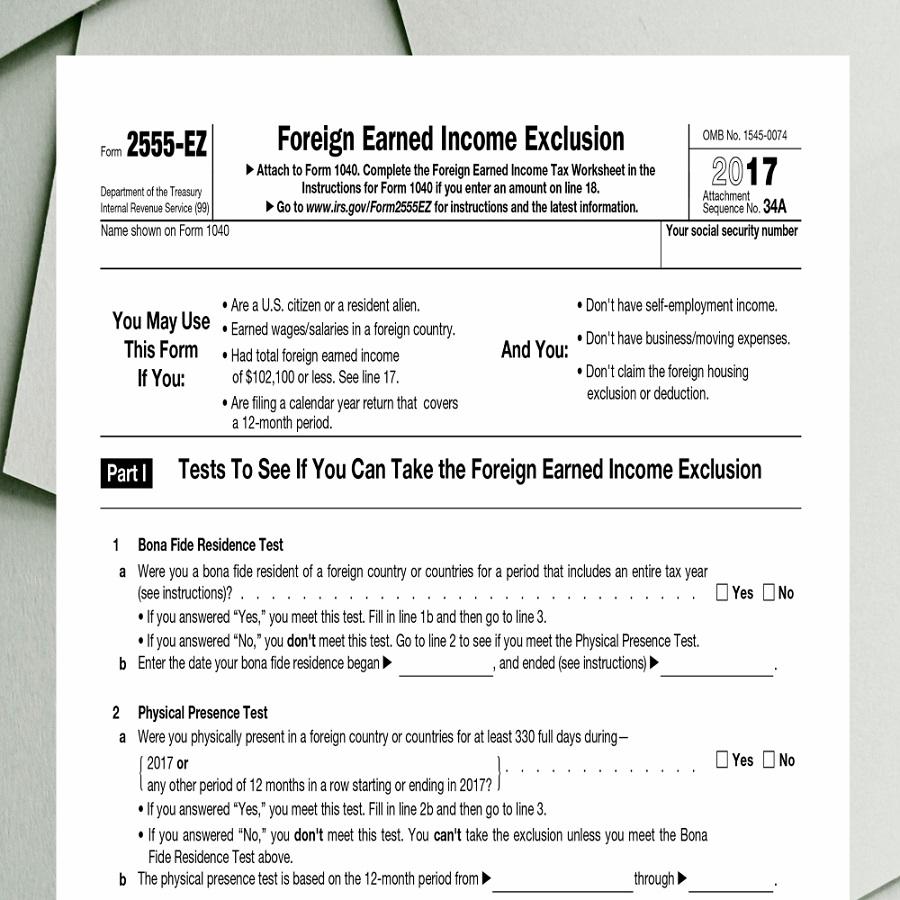

Below are several of the most regularly asked inquiries about the FEIE and various other exclusions The Foreign Earned Revenue Exclusion (FEIE) permits U.S. taxpayers to omit as much as $130,000 of foreign-earned income from federal revenue tax, reducing their U.S. tax obligation responsibility. To get approved for FEIE, you need to satisfy either the Physical Presence Test (330 days abroad) or the Authentic House Test (show your main house in a foreign nation for a whole tax obligation year).

The Physical Visibility Examination likewise calls for United state taxpayers to have both a foreign earnings and a foreign tax home.

10 Easy Facts About Feie Calculator Shown

An earnings tax treaty in between the U.S. and one more nation can aid protect against dual tax. While the Foreign Earned Earnings Exclusion lowers taxed earnings, a treaty may supply extra useful content benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a required declaring for united state residents with over $10,000 in foreign economic accounts.Qualification for FEIE depends on meeting specific residency or physical presence examinations. He has over thirty years of experience and currently specializes in CFO solutions, equity settlement, copyright taxation, cannabis tax and separation related tax/financial preparation issues. He is an expat based in Mexico.

The international made earnings exclusions, sometimes referred to as the Sec. 911 exemptions, leave out tax on earnings made from working abroad.

Feie Calculator for Dummies

The income exemption is now indexed for rising cost of living. The optimal yearly earnings exemption is $130,000 for 2025. The tax obligation benefit omits the revenue from tax obligation at bottom tax prices. Previously, the exemptions "came off the top" reducing earnings topic to tax at the leading tax prices. The exemptions may or might not decrease earnings used for various other purposes, such as IRA restrictions, kid credit ratings, individual exemptions, and so on.These exemptions do not excuse the incomes from United States tax but merely provide a tax reduction. Keep in mind that a solitary individual working abroad for all of 2025 that gained about $145,000 without any other income will certainly have taxed earnings reduced to zero - effectively the very same solution as being "tax complimentary." The exemptions are calculated on an everyday basis.

Report this wiki page